Coronavirus: Mortgage payment holiday extended as house prices 'slow sharply'

Mortgage customers now have until the end of October to request a break from payments while repossessions are further blocked.

Tuesday 2 June 2020 10:27, UK

The City regulator has extended the mortgage payment holiday application deadline for customers struggling to meet payments as a closely-watched report charts a "sharp" decline in house prices amid the coronavirus crisis.

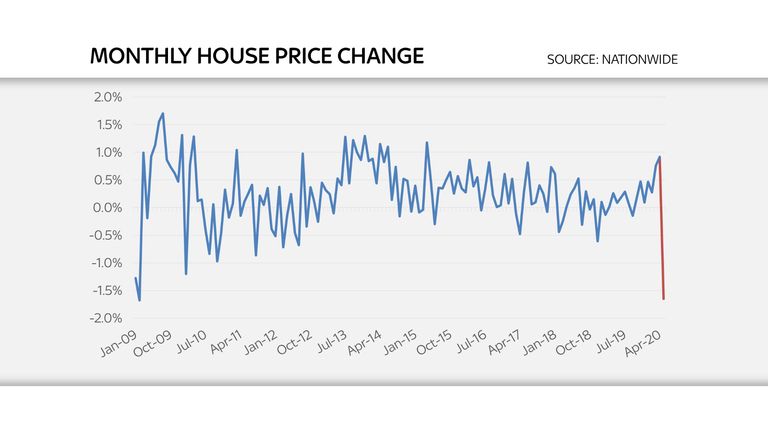

Nationwide's study registered the biggest monthly fall in house prices for 11 years in May as it warned of an extended slump in both mortgage and housing market activity, despite restrictions on viewings and agents' work being eased last month in England.

Its measure of house prices fell by 1.7% in May from April, the biggest decline since February 2009, wiping just over £4,000 from the average value.

In annual terms, prices rose by 1.8%, slowing from 3.7%.

Nationwide said the impact of the COVID-19 pandemic on the mindset of homebuyers was likely to weigh on the market.

A survey it conducted suggested people had put off moving as a result of the lockdown and would-be buyers were planning to wait six months on average.

The mortgage lender's report was released as data from the Bank of England confirmed the extent of the slump in lending - highlighting just 15,848 mortgage approvals in April - a record low and an 80% fall since February.

The central bank showed net mortgage lending of just £300m in April - down from £4.3bn - while repayments on mortgage lending tumbled 26% to £13.9bn, partly reflecting the impact of payment holidays.

The Financial Conduct Authority (FCA) had announced earlier on Tuesday that the deadline for mortgage payment holiday applications had been extended by three months - until 31 October.

A ban on lender repossessions of properties was also confirmed for the same date.

The regulator said the measure would ensure that people were able to comply with the government's policy to self-isolate if they needed to.

The FCA said: "Lenders will continue to support customers who have already had a payment holiday where they need further help.

"Firms should contact their customers to find out what they can re-pay and, for those who remain in temporary financial difficulty, offer further support, which will include the option of a further three-month full or part payment holiday."

Economists widely believe the impact on earnings during the UK lockdown will also hit house prices as the year continues.

Samuel Tombs, economist with Pantheon Macroeconomics, said: "The huge size of the blow from COVID-19 to households incomes and the deterioration in consumers confidence suggests that house prices must drop.

"We look for a 5% decline in prices by the end of the third quarter."