Coronavirus: Wartime levels of debt triggered by invisible peacetime聽foe

The UK may not be done with setting painful economic records as the government wrestles with the pandemic fallout.

Friday 19 June 2020 11:19, UK

Week-by-week, month-by-month, COVID-19 continues to stretch the government response to new levels of state intervention to combat the disease and support the economy.

Those twin aims have now taken the public finances to levels of indebtedness that are both symbolically and statistically significant.

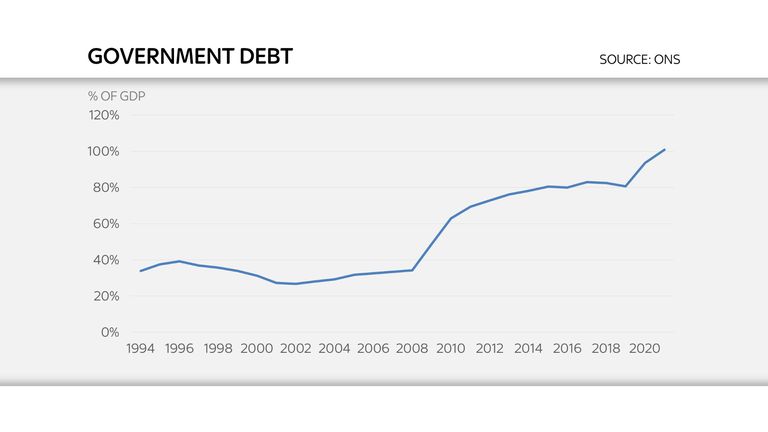

For the first time since 1963, a 57-year period that spans five recessions, the national debt is forecast to be greater than the national income.

Put another way, the UK will owe more than the entire economy produces this year.

According to the Office for National Statistics (ONS) public sector net debt will reach £1.95trn this year, or 100.9% of gross domestic product.

The nation has been nudged past this milestone by record borrowing in the last two months.

In May, the government borrowed £55.2bn, the highest monthly borrowing since records began in 1993 and nine times more than the £5.6bn required last May.

The ONS estimates the total for the last two months is £103.7bn, itself a two-month record and up more than £87bn on the same period last year.

Such is the scale of current crisis that annual comparisons are rendered meaningless.

Even recent catastrophes such as the financial crash in 2008 have been eclipsed by the response to the coronavirus and the economic crash triggered by the COVID-19 lockdown.

These are wartime levels of debt triggered by a peacetime foe we cannot see and are yet to send packing.

The government has had to borrow to fund the health response and the huge programme of economic support, all at a time when tax receipts have plummeted.

The job retention scheme supported the furloughing of 8.7m workers in May at a cost of £17.5bn, with a further £7.6bn spent on supporting 2.5 million self-employed.

The good news is that this money has kept a large number of people in employment, for now at least.

The bad is that these figures have not yet peaked.

In the fortnight since, the bill has risen by another £1.3bn as 300,000 more people joined those already having their wages paid by the state.

:: Listen to the The World Tomorrow on , ,

At the same time spending has plummeted, precisely because the government closed shops, told us to stay at home and in many cases paid us to do so.

VAT and rate holidays have reduced the amount the Treasury is taking in each month, leaving it with no choice but to turn to the money markets and increasingly the Bank of England to fund the shortfall.

With interest rates at record low levels this level of borrowing may not be unaffordable.

Less certain is how quickly the economy will recover to help the process of paying it down.

Little wonder the Chancellor Rishi Sunak highlighted the reopening of some shops this week as an important step.

Retail figures for May also released today show a 12% recovery on April, when all but essential shops were shuttered, led by hardware shops and garden centres.

June should show another improvement but there is no easy measure of consumer confidence to start spending with profound uncertainty over jobs as the furlough scheme is withdrawn.

Next month, the government is promising news of a stimulus package intended to kick-start the recovery, with a focus on jobs surely inevitable.

But that will come at a price too and Mr Sunak, much praised for the speed and scale of economic support, will earn his wage in the months that follow as the taps are turned off.

He, and the country, may not be done with painful records.