FTSE 100 fights back after worst day since Brexit result

Investors continue to monitor a cocktail of concerns but take heart from a leap in oil costs and a weaker US jobs market.

Friday 7 December 2018 16:49, UK

The FTSE 100 has been recovering some ground, 24 hours after its biggest percentage fall since the Brexit referendum result.

London's blue chip index followed Asia higher and was over 2% up at one stage on Friday afternoon.

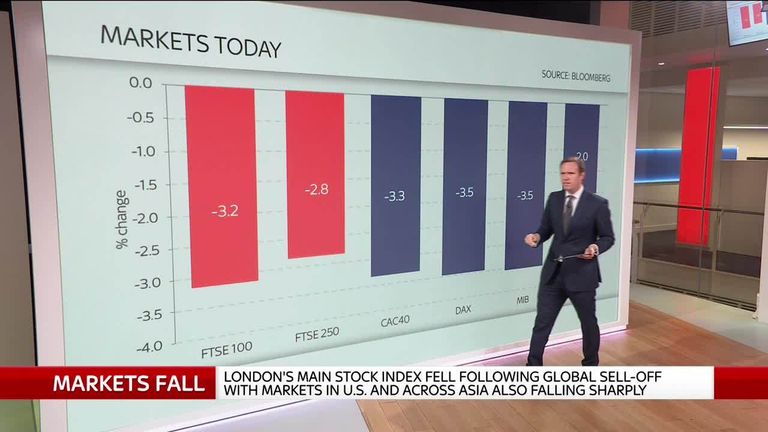

:: FTSE suffers worst one-day fall in over two years

Traders said values were bolstered, following Thursday's 3.2% decline, by weaker-than-expected US employment numbers which suggested a possible slower path for US interest rate rises.

Energy and other commodity stocks also rose after news of a looming production cut by the OPEC cartel of oil-producing nations and Russia.

That helped raise recently damaged Brent crude prices by 5% to almost $63 a barrel.

However, the FTSE gave up some gains late in the session to close 1.1%, or 74 points higher, at 6778.

The US economy and weak oil costs have formed some of the main worries for investors this week - but the state of the US-China trade war has dominated deals.

Shareholders took fright on Thursday when it emerged the chief financial officer at Chinese telecoms giant Huawei had been arrested at the request of the US.

Meng Wanzhou faces extradition from Canada over allegations the global firm broke US sanctions against Iran though a bail hearing was set for later on Friday.

Her detention exacerbated fears that the trade war ceasefire agreed between Donald Trump and his Chinese counterpart Xi Jinping at the G20 summit last weekend was not the breakthrough the market had originally thought.

:: 'Bad Trump' to blame as global markets tumble

Following Thursday's share bloodbath across Europe, the Dow Jones ended just 0.3% lower on Wall Street after an initial heavy sell-off of almost 800 points while the tech-dominated Nasdaq also fought back to close the session slightly up.

Hong Kong's Hand Seng and the Nikkei in Tokyo were both up on Friday - but not by much.

The FTSE's early gains were tempered by some retail pressure after a pre-AGM statement from the owner of Primark reported "negative" like-for-like store sales in November.

Associated British Foods led the fallers for much of the day. Other stock markets in Europe also saw tentative gains though Germany's DAX was flat after disappointing domestic economic data.

Providing some of the market support were investor hopes the US Central Bank will react to growing fears of a US recession by not raising interest rates by as much next year as it had previously indicated.

Their case was supported by the key US employment numbers, which showed hiring and wage growth was weaker than expected last month.

That helped the dollar lose value and US stocks to pare losses at the open though the Dow Jones Industrial Average later turned negative - aided by its tech and health constituents.

Rising rates make it more expensive to borrow to invest and it has been a core reason behind selling on world markets this year following a gradual end to post-crisis central bank stimulus.

Analyst Neil Innes, head of Asia-Pacific trade at OANDA, suggested markets may have overreacted this week.

He told the AP news agency: "The Huawei headline could not have come at a worse time, with the market reeling as confusion reigned over the G20 fallout.

"But when you laminate trade war issues with observed dovish shifts from major central banks, it merely adds a whole new level of unwanted confusion entering year-end."

He added: "I'm trying to suggest... we were going through a market-driven event rather than a meaningful shift to the dark economic side that had all the doom and 'gloomers' coming out of their caves this week."