Why has Unilever's decision to move to Amsterdam upset investors?

City investors are up in arms at what they see as an effective takeover of their company, without them receiving any compensation.

Tuesday 18 September 2018 11:23, UK

The fuse has been lit today on a potentially explosive row between one of Europe's largest companies and its City shareholders.

Unilever, the Anglo-Dutch consumer goods giant behind brands such as Persil, Marmite, Magnum and PG Tips, wants to simplify its corporate structure.

It presently has two parent holding companies - Unilever plc, whose shares are listed in London and New York - and Unilever NV, which is based in Rotterdam and whose shares are listed in Amsterdam and New York.

Under the proposals, shares of Unilever plc would be replaced with one new share in Unilever NV, while the two parent holding companies would be replaced simply by Netherlands-based Unilever NV.

Shares of Unilever NV would continue to be traded in London and New York, as well as in Amsterdam, but with a crucial difference to the present arrangement.

For Unilever has conceded that Unilever NV would be "extremely unlikely" to qualify for membership of the FTSE-100 as do the current shares of Unilever plc.

That will force a number of shareholders, mainly the tracker funds who seek to replicate the performance of the FTSE-100, to sell their shares.

As Unilever is one of the largest companies in the Footsie- the combined market capitalisations of Unilever plc and Unilever NV give it a valuation of £124bn, putting it behind only Royal Dutch Shell and HSBC Holdings - there has to be a danger that this will sharply depress the share price, with so many investors heading for the exit at the same time.

Accordingly, this has left a very bad taste in the mouths of many Unilever shareholders, who argue that they are being forced to give up their shares but without any kind of takeover premium - as one would normally expect - being paid.

The alternative to being forced to sell their shares, fund managers point out, is to risk breaking the mandate under which they operate.

Unilever stresses that no jobs will be lost as a result of the reorganisation, under which it would no longer be a British company, since its company registration, primary listing and headquarters would be in the Netherlands.

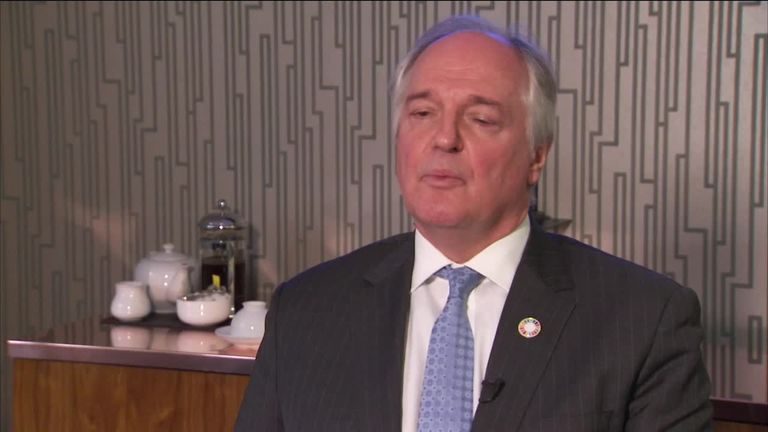

Paul Polman, Unilever's Dutch chief executive, insists the move to one legal entity will give the company greater flexibility, for example, in using its shares as a currency in future acquisitions.

He argues that the reduction of complexity will also strengthen Unilever's corporate governance.

Yet many in the City smell a rat. In February last year, Unilever received an unwanted $143bn takeover approach from Kraft, the US consumer goods giant still notorious on these shores for its £11bn takeover of Cadbury just under a decade ago.

Kraft's interest was easily repelled, but the move gave Unilever's board the shock of its life, immediately sparking big changes in the way the company is run.

Becoming a purely Dutch company will protect Unilever from future bids like Kraft's because Dutch firms enjoy greater protection from takeovers than British ones. That, UK investors suspect, is the real reason for this reorganisation.

Unilever has also argued that there is greater turnover of shares in Unilever NV than there is in Unilever plc - making the Dutch class of share the obvious one in the reorganisation.

That overlooks the fact that the London stock market is substantially bigger than its counterpart in Amsterdam and that the greater number of shares in Unilever NV actually change hands in London.

What makes this decision really interesting is that Relx, the Anglo-Dutch business information company, has just carried out a similar simplification of its shares.

The only difference is that Relx, formed in 1992 from the merger of British publisher Reed International and Dutch firm Elsevier, has opted for Relx plc shares to be the sole class of share going forward.

Meanwhile, Royal Dutch Shell, the other big Anglo-Dutch corporate giant, has its company headquarters in the Netherlands, but the primary listing for its shares is in London.

This issue has attracted far more attention in the Netherlands than it has in the UK - because the Dutch prime minister, Mark Rutte, has eased the way for Unilever by proposing to abolish the country's 15% withholding tax on company dividends.

Ironically, this merely brings the Netherlands into line with the UK's taxation regime, but is widely regarded as having helped influence Unilever's decision.

However, it has also kicked up a political stink in the Netherlands, with many people unhappy at what they see as a generous tax cut to big business. It is possible Mr Rutte may yet fail to get the legislation through the Dutch parliament.

And Unilever may also yet fail to get this measure passed by its investors. Shareholders of Unilever NV will vote on the proposals on 25 October with shareholders of Unilever plc giving their verdict the following day. Unilever requires the support of three-quarters of the latter for the measure to go ahead.

With many British investors up in arms at what they see as an effective takeover of their company, without them receiving any compensation, it could be close.