Why the pound enjoyed a surprise rally despite Brexit drama

You might think parliament's decision to vote down Theresa May's deal would spark a further fall in the pound but it didn't.

Tuesday 15 January 2019 22:56, UK

There are few better barometers of a country's standing in the world than its exchange rate.

It is, after all, the aggregation of millions of decisions being taken by millions of people across the country and around the world: whether to put their money into Britain or take it out.

Whether to build that new factory or buy that house, or to put the money in investments elsewhere instead.

The level of the currency reflects all sorts of things, but chief among them is an assessment about how investments in a given country will perform over the coming years. So it is little surprise that since the UK voted to leave the EU the currency has been quite so volatile.

All of a sudden the range of possibilities for the UK economy widened enormously: from a disruptive Brexit on the one hand to more or less the status quo on the other. According to most economists, these paths would imply dramatically different outcomes for the performance of UK investments in future.

So perhaps one might have expected that parliament's decision to vote down Theresa May's deal would have provoked a further fall in the pound, as investors prepared themselves for more chaos and uncertainty. Indeed, speaking to Sky News shortly after the vote that is precisely what Lord Mandelson, the former business secretary predicted, unless Mrs May ruled out no deal.

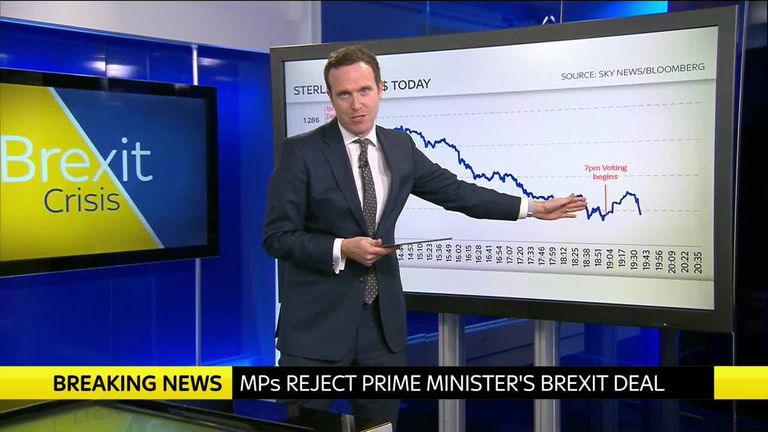

But here's the thing: that didn't happen. The pound, which had been weakening throughout the day, dipped slightly against the US dollar when the result of the vote was read out in the Commons. But then, when Theresa May got to her feet in the following minutes, something unexpected happened. It rallied. It rose as she vowed to fight on; it rose as she said she would find time for a vote of no confidence in her government; it rose as Jeremy Corbyn said he would table that motion.

On the one hand you might have thought this rather odd: the prospect of yet another crash election and yet more months, perhaps years, of uncertainty.

But it seems investors view the events of the day differently. It seems the overriding interpretation of today's vote is that it makes a softer Brexit more likely. Investors seem to be betting that if Theresa May is forced to compromise with MPs (provided she survives, that is) she will compromise in the direction not of the ERG hard Brexiteers, but in the direction of those in her party and on the opposite benches, who would prefer a Brexit that more closely resembled a customs union or Norway arrangement.

Then, of course, there's the Corbyn factor. It is no secret that many investors dread the prospect of a Labour government even more than they do the prospect of a hard Brexit. The consensus in Parliament tonight appears to be that the Prime Minister should win her confidence vote, which might prove a serious setback for Mr Corbyn. Another reason, according to some currency strategists, that the pound has found this unexpected strength.

Of course, one has to take all these predictions with a major dose of salt - as indeed one should take any so-called wisdom about currency moves. But for all the forecasts of market chaos, today brought us a very different story altogether.